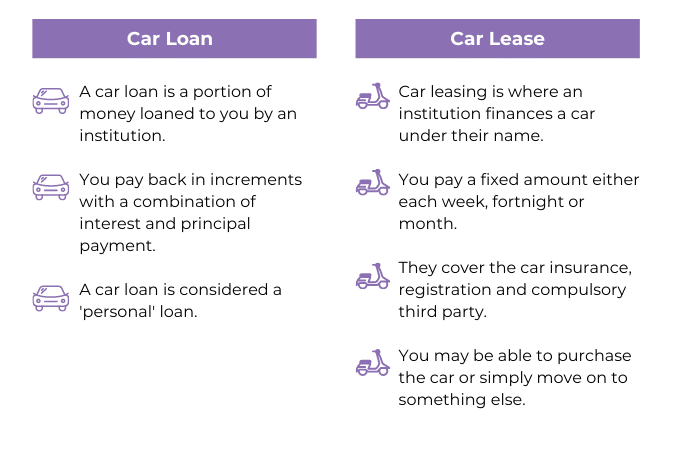

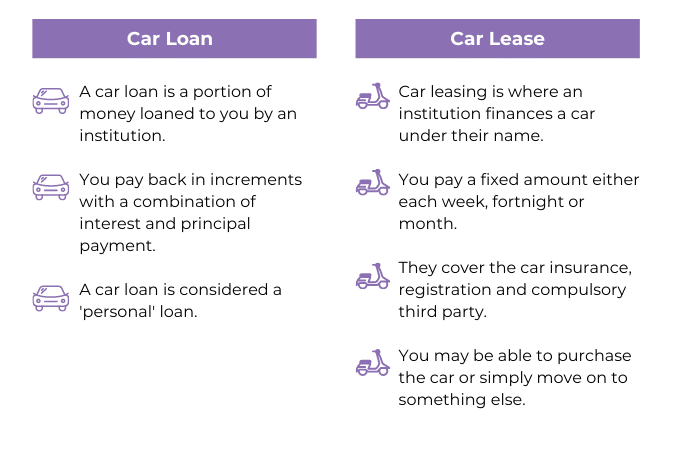

One of the most popular options for owning a safe, modern and affordable vehicle is a car loan and lease scheme. There are many options available at the moment and it can be tricky to determine what has the best rate, lowest interest and what you can afford in conjunction with your lifestyle.

To put it simply

Choosing to loan or to lease a car comes down to your priorities. With a car lease, the monthly payment is usually lower than loans, [however] you’re not building up any equity in the vehicle with those payments 1. Car leasing could be the option if you’re needing to manage your cash flow as the payments are usually low weekly expenses. With a car loan, you have more tangible ownership on the vehicle and you work at repaying off the loan, to eventually own the car outright.

Does Credit History Matter?

Depending on the institution, if you have a poor credit score, you can still be accepted for a loan or lease. Alpha Finance specialises in helping Australians acquire a vehicle even if their credit history is not squeaky clean.

Key considerations

- Your cash flow: Leasing a car often has a lower regular payment in comparison to repaying a car loan. With a lease, you’re paying for the depreciation of the car, rather than the whole vehicle cost. Compulsory third party insurance and registration is usually covered by the institution.

- Driving: If you’re driving your vehicle all around town and want to go on some road trips as well, then owning your car outright would be the most cost-effective option. Most leasing contracts have a kilometre allowance where you pay more cents for ever kilometre over the allowance.

- Upfront payment: Most loan and lease agreements will have an upfront payment to secure the vehicle. Leasing usually has a lower upfront payment as you’re not committing to purchasing the vehicle, this also helps balance out your cash flow as you’re not needing to save as much for the initial payment.

Before you sign any dotted lines, it’s best to sit down and write out your expenses in relation to your cash flow. That way, you can easily determine whether you can afford the loan repayment or leasing a vehicle may be a better option. Alpha Finance has a team of specialists to help you determine if what the best option is for you.

- Pinola. “When Is Leasing A Car Better Than Buying?”. Accessed May 14, 2019.