Introducing South Africa’s First Debt Installment Calculator

Managing debt can feel overwhelming, especially for those trying to achieve financial stability. But now, South Africa has introduced a new, innovative tool: the Debt Installment Calculator. This tool helps users get an initial debt review quote without needing to consult a debt counsellor first.

Book your Free Consultation Below

The Debt Installment Calculator plays a key role in making the debt review process easier to understand. It allows users to see their potential debt repayments from home. By entering some basic financial details, users can get an estimated monthly payment, which helps them make decisions more easily. This kind of accessibility is essential for those starting their journey to better financial health.

The main goal of this calculator is to help users make informed financial decisions. Unlike traditional methods that often require visiting a debt counsellor, this tool gives users instant insights into their financial situation. This initial assessment helps users prepare for more detailed discussions with financial experts, making debt management more efficient overall.

The Debt Installment Calculator is all about convenience and efficiency. Users don’t have to deal with confusing financial terms or lots of paperwork at the start of their debt management journey. Instead, they can use this easy-to-use tool, which automates and simplifies the estimation process. For anyone serious about achieving financial stability, this calculator is a vital resource, making complex debt calculations more accessible and straightforward.

How does the Debt Installment Calculator work?

The Debt Installment Calculator uses advanced technology to get accurate and current debt information from a registered credit bureau. This connection ensures the financial data is secure and reliable. When users enter their details, the system safely accesses their debt information without risking their privacy or data security.

The protection of sensitive financial data is a top priority. The calculator uses strong encryption methods and follows strict data protection rules to keep user information safe during transmission. By encrypting every transaction, users can feel confident that their financial data stays private and secure.

In addition to its secure features, the calculator is built with the user in mind. The input methods are simple and easy to use, allowing people to enter their details without any hassle. The interface is designed to be intuitive, so users can navigate it easily without needing technical help. This combination of easy data entry and smooth integration with credit bureaus makes the Debt Installment Calculator accessible to users with different levels of tech skills.

Additionally, the calculator provides accurate and real-time information, giving users an up-to-date view of their financial obligations. This helps individuals make informed decisions based on the latest data. The smooth process, from entering details to getting accurate debt information, makes this calculator a groundbreaking tool in debt management.

Step by Step instructions.

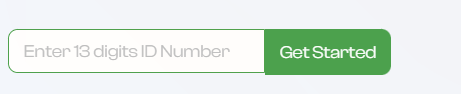

Step 1

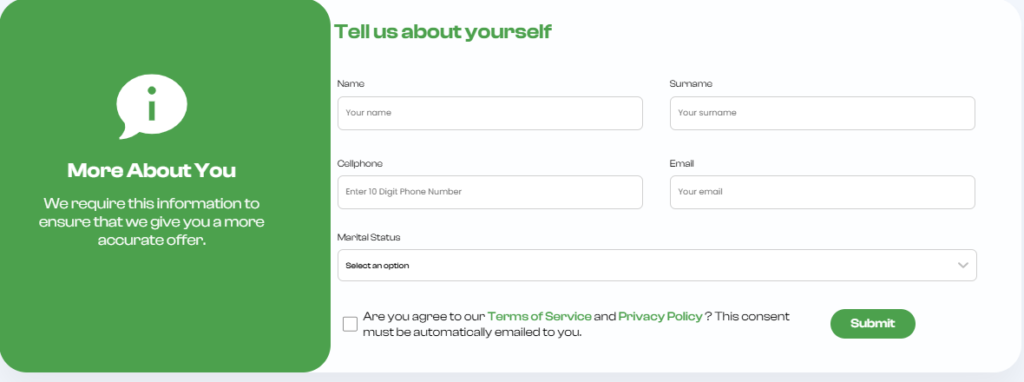

Step 2

Capture your Name, Surname, Contact Number, Email Address, Marital Status (Remember your spouse details if you are married in community of property).

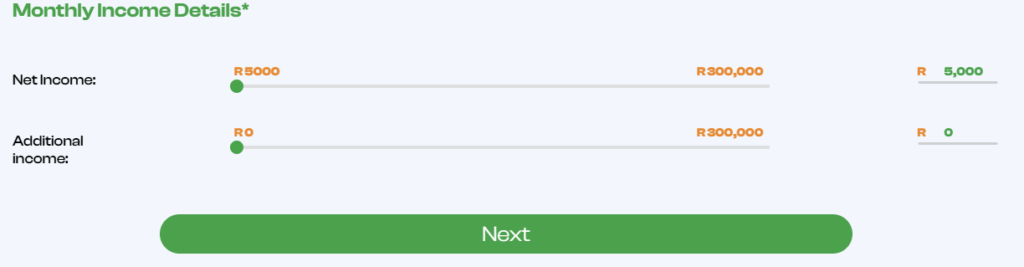

Step 3

Enter your income details

Step 4

Step 5

Confirm your debt obligations as per the live credit bureau information. Add missing accounts, select what accounts you wish we investigate reckless lending on, see possible prescribed accounts etc.

Step 6

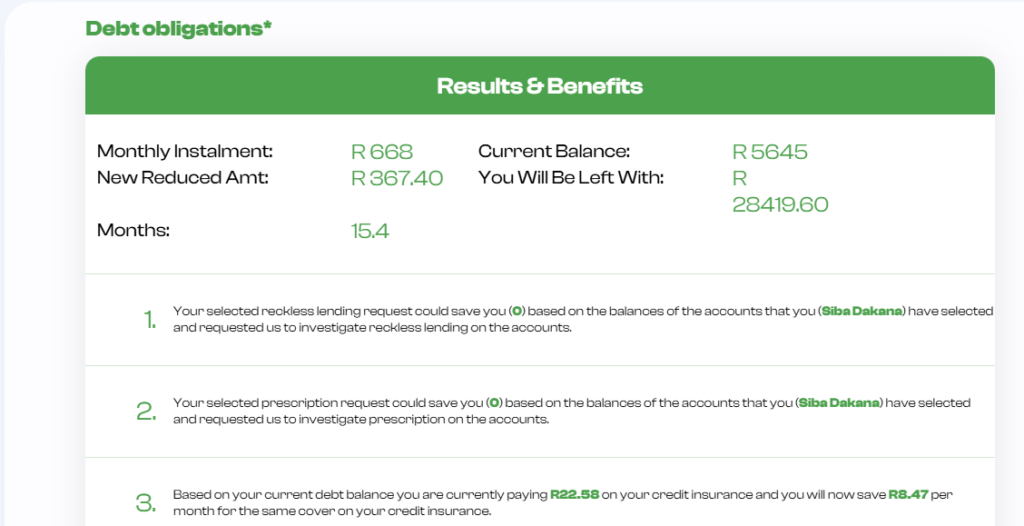

See your Results & Secure your Quote

Advanced Algorithms for Accurate Debt Repayment Calculations

At the core of South Africa’s first Debt Installment Calculator are advanced algorithms that ensure precise and reliable debt repayment calculations. These sophisticated algorithms take into account various factors such as an individual’s income, expenses, and existing debt levels. By thoroughly analyzing this personal financial data, the calculator creates customized repayment plans that are both practical and sustainable for users.

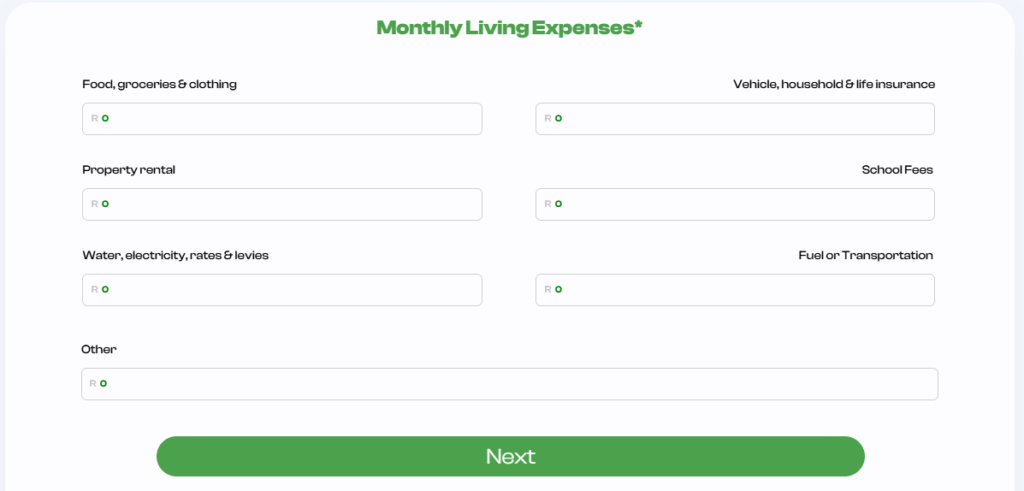

The accuracy of these algorithms is crucial for their effectiveness. They use current, real-world financial data to ensure the calculations reflect a person’s true financial situation. This includes considering all sources of monthly income, regular expenses like utilities, groceries, and transportation, as well as any outstanding debts such as loans and credit card balances. The result is a comprehensive view of a user’s financial health, providing a strong basis for creating a personalized debt repayment plan.

What makes this Debt Installment Calculator unique is its ability to adapt to changes in a user’s financial situation. Whether there’s an increase in income, a decrease in expenses, or an unexpected financial challenge, the algorithms can update the repayment plan to keep it manageable and realistic. This flexibility allows users to continuously track their progress and make necessary adjustments to stay on course with their debt repayment goals.

Additionally, the accuracy of these calculations helps users make informed decisions about managing their debt. By knowing exactly how much they need to pay each month, users can avoid overextending themselves financially. This insight promotes better budgeting habits, reduces the risk of accumulating more debt, and leads to more effective debt resolution.

In summary, the advanced algorithms behind this Debt Installment Calculator make it an essential tool for anyone looking to manage their debt more effectively. By providing accurate and personalized repayment plans, it helps users understand their financial situation clearly and make better decisions, leading to a debt-free future.

Benefits of Using the Debt Installment Calculator Before Visiting a Debt Counsellor

The launch of South Africa’s first Debt Installment Calculator is a major breakthrough for those wanting to manage their finances better. Using this tool before meeting with a debt counsellor offers many practical benefits that can greatly influence one’s debt management journey. One of the main advantages is the time it saves. By entering their financial information into the calculator, individuals can quickly get an overview of their financial situation, making the following counseling session more focused and productive.

Additionally, the clarity provided by the Debt Installment Calculator is invaluable. Having a clear understanding of one’s financial situation beforehand allows individuals to approach their debt counsellor with a well-informed perspective. This preparation can streamline discussions and ensure that both parties are aligned from the start. Knowing the details of one’s debts and potential repayment plans sets the stage for meaningful and productive conversations.

Another significant benefit is the potential for stress reduction. Financial challenges are naturally stressful, but using the calculator for a preliminary assessment can ease some of this burden. This empowerment comes from having a clear, data-driven understanding of what to expect. When people see realistic ways to manage their debt, it can boost their confidence and reduce anxiety about their financial future.

Finally, the empowerment that comes from having a preliminary plan is significant. The calculator lets users try out different repayment scenarios, giving them control over their debt management strategy. This proactive approach is essential for fostering a sense of ownership and responsibility over their financial decisions.

Using the Debt Installment Calculator before meeting with a debt counselor helps individuals take the first step towards a more organized and informed debt management plan. This innovative tool empowers users to proactively manage their debt, leading to better financial health and overall well-being.