by Hope

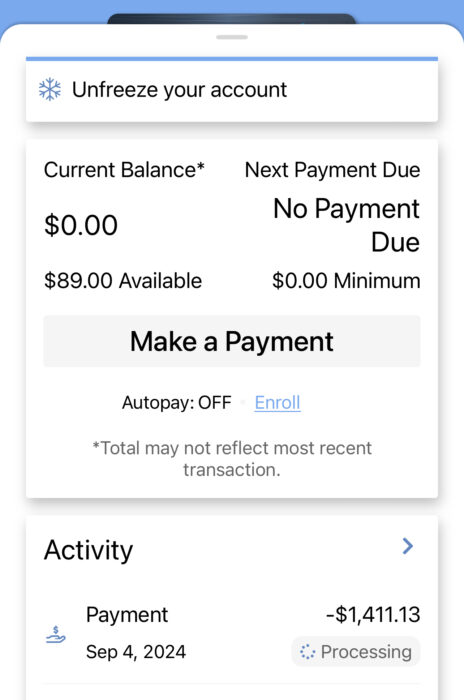

Another debt bites the dust. Amazon CC debt be gone!

Some of you may remember that this debt has been almost gone before…just a few months ago. And then I went a little spend happy and ran it back up. No more!

I’ve hesitated to cancel this account due to it being my second oldest credit account so I know closing it will adversely affect my credit score much more than the other cards that I’ve already closed. But just like then, I’ve decided that I do not care about my credit score. I have to remove even the temptation to use this car again.

This card will be closed. Once the payment is cleared and settled.

The total paid today is: $1,412. And it feels soooo good to have another account paid in full.

(Sidenote: the two cards that I’ve already paid and closed have emailed me almost weekly to get me to reinstate the cards. Is that normal? But I am not even tempted.)

What’s Next?

Based on my last debt update, my plan was to pay off my Frontier credit card next. And I figured it would take a couple of months because of my income and the balance. But now I have full time income. HOWEVER…

I’ve mentioned at least once, maybe a couple of times, that Princess must get her wisdom teeth out. And we did get a consult last month. The total for the surgery will be $4,010. I paid $400 of that at the time of consult. We have scheduled the surgery for next month (October, 2024) after her mid-terms.

So my plan is to pay the Frontier card in full at the beginning of October. Then I will have to turn around and use the card for the surgery. This will save me 1/2 month of interest accruing. And then I will pay it off again in its entirety again in November. And then cancel the card.

Is this a good plan, a good use of credit card at least temporarily? Or am I making a bad call with this plan?

Hope is a creative, solutions-focused business manager helping clients grow their business and work more efficiently by leveraging expertise in project management, digital marketing, & tech solutions. She’s recently become an empty nester as her 5 foster/adoptive kids have spread their wings. She lives with her 3 dogs in a small town in NE Georgia and prefers the mountains to the beaches any day. She struggles with the travel bug and is doing her best to help each of her kids as their finish schooling and become independent (but it’s hard!) She has run her own consulting company for almost twenty years! Hope began sharing her journey with the BAD community in the Spring of 2015 and feels like she has finally in a place to really focus on making wise financial decisions.