Misleading DMP advice

Mrs B was advised to go into a Debt Management Plan (DMP) by an IVA firm. They referred her to a firm that charges fees for running a DMP.

I suggested that she should talk to StepChange or another provider that doesn’t charge any fees for a DMP.

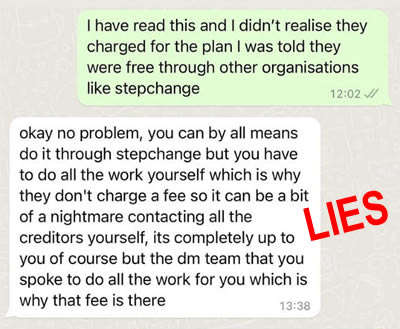

Mrs B went back and queried the advice with the IVA firm. This is the WhatsApp conversation:

I explained to Mrs B that this was nonsense. StepChange do all the work when they set up a DMP. They work out pro-rata payments from the amount Mrs B can afford, notify the creditors and make the payments each month. If a debt is sold by a lender to a debt collector, StepChange switches to paying the debt collector.

And the same applies to other fee-free DMPs such as Payplan or Christians Against Poverty.

The only difference with a fee-charging DMP firm is that they deduct their fees first from the monthly DMP payment, so the creditors get less. As a result, a fee-charging DMP goes on for months or years longer than a free one does.

Mrs B now has a DMP set up by StepChange and is happy. But she was pretty cross at being given such misleading information by the IVA firm. The IPA, who regulates the Insolvency Practitioner at the IVA firm, has Mrs B’s complaint with all the details.

I am not naming the IVA firm, or the fee-charging DMP firm they tried to get her to sign up with, here. It’s up to the IPA to investigate the complaint and I am interested in the general subject, not this individual case.

Regulatory whack-a-mole

The background to this is the changing shape of FCA and Insolvency Service regulation.

The FCA became responsible for regulating debt management firms in 2014. It published a review on the Quality of debt management advice in 2015. This started by saying:

Individuals trying to deal with problem debt … can be prey to firms that do not have customers’ best interests at heart and do not treat them fairly.

And concluded with:

Our findings were very disappointing and have reaffirmed our view that poor debt management firms pose a high risk to consumers (particularly those in vulnerable circumstances).

By March 2016 no firms had yet been fully authorised and the FCA said:

- more than a hundred firms had exited the market;

- there were about 400,000 clients on fee-charging DMPs.

More firms dropped out after that or were refused authorisation. Few fee-charging DMP firms were eventually authorised in 2017.

Some firms exiting the fee-charging DMP business in 2015-16 may have turned into IVA lead generators, using the PERG 2.9.25-27 exemption to avoid FCA regulation. But when the Insolvency Service started to try to crack down on unregulated lead generators, it may have become convenient for some lead generation to be run through FCA-authorised entities for debt advice.

The FCA then faced the problem of very poor “advice” being given by firms whose only significant revenue came from IVA referrals. It proposed a ban on referral fees for “debt packagers” in 2021, which came into force in 2023.

Since then, anecdotally, creditors are seeing increasing numbers of payments being made to fee-charging DMP firms.

So could some “debt packagers” be getting round the FCA ban by also referring clients to fee-charging DMP firms, not just IVA firms? Or by setting up their own fee-charging DMP operations?

“First Advice” is crucial

The FCA’s 2015 Review identified that:

Information about the availability of free advice was either not provided, was not sufficiently prominent or was biased against, or derogatory about, the free sector.

And it seems this is still carrying on in 2024.

It may be that the fee-charging DMP firm Mrs B was referred to would have given good advice about the availability of free DMPs. But the damage has already been done by then. If the FCA-authorised fee-charging firm said “there are free DMPs if you want”, someone who has been told they are a “nightmare” isn’t likely to go and investigate them.

We have been through the same situation with IVA referrals. An IVA lead generator can give a misleading optimistic impression of how an IVA works, tell the client they aren’t eligible for other debt solutions, reassure the client that naturally they don’t want to go bankrupt… After that the IVA firm may give detailed information, but the client is already sold on an IVA being the best thing ever and isn’t really listening.

Insolvency Practitioner Association (IPA) rules

The IPA’s Ethics Code

The IPA ethics code says:

R330.11 A3 When communicating information about any referral or agency arrangements the insolvency practitioner should provide the following information:

• the advantages and disadvantages of the service or product being provided;

• that similar services or products could be available from other providers at a different cost,

• any direct or indirect benefit that the insolvency practitioner or the firm might receive if a service or product is taken up;

• that seeking independent advice should be considered.

None of that happened with Mrs B when she was first referred. And when she queried the referral she was given highly misleading information.

More generally, the Code also says:

R330.9 An insolvency practitioner shall not make a referral to a third party, even with a disclaimer, if they know of a better alternative.

R330.10 The insolvency practitioner shall document the reasons for establishing an agency with another supplier or recommending a particular provider.

It would be interesting to see how an IVA firm can justify the referral to a fee-charging debt management plan. How is it in the interest of a client to end up in a DMP that takes much longer?

But is this enforced?

So we have a situation where the IPA rules look OK but may be being ignored. With falling IVA numbers it is possible that some IVA firms are now seeing fees for referrals to fee-charging DMPs as a good source of income, so this is becoming more important.

It would be useful if the IPA started asking routine questions about DMP referrals:

- how many referrals are currently made to fee-charging DMPs by IVA forms? Has this increased over the last 2 years?

- how have you decided who to refer to and is a referral to a fee-charging firm in the best interest of your clients?

- what information do you give clients about fee-free DMPs?

FCA rules

The referral and the misleading information came from an IVA firm that was not FCA-authorised and did not need to be because of the PERG exemption. But if Mrs B had followed the referral and spoken to the FCA-authorised firm that charges for DMPs, the FCA’s CONC 8 rules would have applied.

Informing clients about fee-free DMPs

CONC 8.2.4 says:

A debt management firm must prominently include:

(1) in its first written or oral communication with the customer a statement that free debt counselling, debt adjusting and providing of credit information services is available to customers and that the customer can find out more by contacting MoneyHelper.

When a referral comes from a third party such as an IVA firm, this can hardly be described as a good consumer journey.

If Mrs B had talked to the fee-charging DMP firm, she would already have been on her third different contact (lead generator – IVA firm – fee-charging DMP firm). So even if she hadn’t been lied to about StepChange, would she be likely to go off and explore the Money Helper website to find links to other DMP firms?

If she did, she would find that the Money Helper website doesn’t even say which of the firms it provides links to will run DMPs. Most people seeking debt help are stressed and may be vulnerable. A better way has to be found to get them the advice they need with as few steps as possible.

In the best interest of the client?

Fee-charging DMP firms should comply with CONC 8.3.2 which says:

A firm must ensure that:

(1) all advice given and action taken by the firm or its agent or its appointed representative:

(a) has regard to the best interests of the customer;

But how is it ever in the interest of a client to be in a DMP which will take much longer?

And do fee-charging DMP firms explain to their clients the reason why they consider a fee-free DMP is unsuitable (CONC 8.3.2 (3))?

What level of fees are acceptable?

The Consumer Duty has brought a sharper focus to the issue of value for money for clients:

PRIN 2A.4.2 A manufacturer must: (1) ensure that its products provide fair value to retail customers in the target markets for those products

CONC 8.7 says DMP fees should be less than half of the payments a customer is making each month. The details vary a lot between firms, with different charging structures and different setup and ongoing fees.

Anecdotally there are reports from creditors that many fee-charging DMPs seem to be close to the 50% cap on fees. So a DMP that could end in four years with a free DMP would take nearly 8 years with a fee charger.

What extra value is a fee-charging firm is adding to justify such a substantially longer debt-free journey? In its review of CONC 8, the FCA should seriously consider a major reduction in the permitted fees.

DMP firms’ fees are frequently buried away on their website – they need to be much more prominent. There is nowhere independent that lists all the firms that provide DMPs and what they charge. So there is no simple way for any consumer to make a comparison.

The FCA, which is reviewing CONC 8, should consider setting up such a page or asking Money Helper to set it up. It should then be a condition of being authorised to run DMPs that a firm provides details about all its fees to go on this comparison site and links to that comparison site prominently on its home page.

Paying DMP fees? Change to a free plan!

If you have a DMP with a fee-charging firm, talk to StepChange about changing to them!

You don’t need to worry this will harm your DMP, or that your creditors won’t like the change. Creditors will like being paid more quickly in a StepChange DMP as no fees are paid and all your monthly payment is divided between your creditors. So for the same monthly payment, your DMP will end sooner.