Learn How Car Loan Interest Affects How Much Your Car Costs

When you take on a car loan to buy a car, your lender purchases the car for you and allows you to pay it back over a period of years. Essentially, the lender gives you the service of using its money, and in exchange, you compensate the lender for its services by paying interest.

Most car loans use simple interest, a type of interest of which the interest charge is calculated only on the principal (i.e. the amount owed on the loan). Simple interest does not compound on interest, which generally saves a borrower money.

However, simple interest does not mean that every time you make a payment on your loan that you pay equal amounts of interest and principal. Instead, car loans are paid down via amortization, meaning you pay more interest at the beginning of your car loan than at the end.

How and When Do I Pay Car Loan Interest?

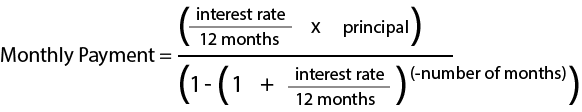

Let’s say you take out a car loan for $12,000 to be paid back over five years (or 60 months) at an interest rate of 10%. Your monthly payments for this loan would be $254.96. You can calculate the payment yourself using the following equation:

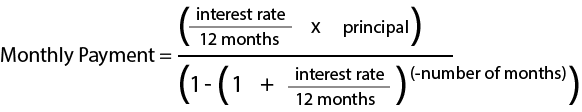

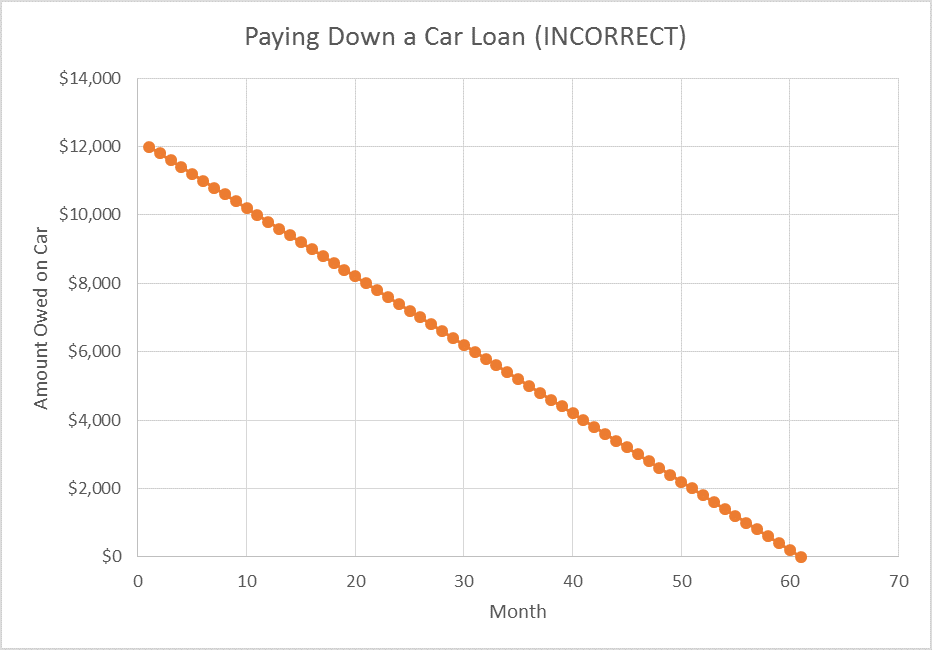

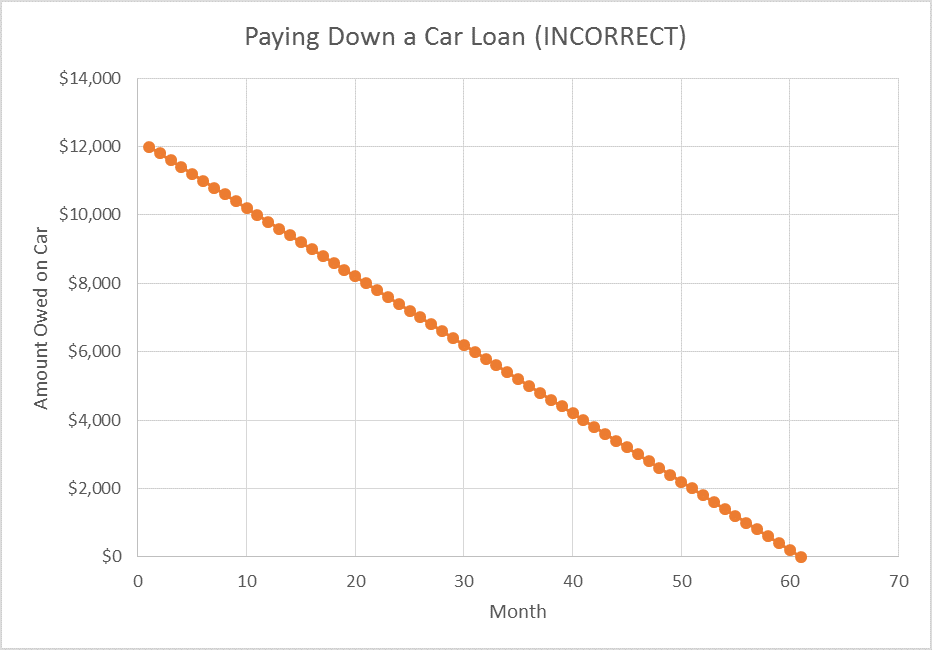

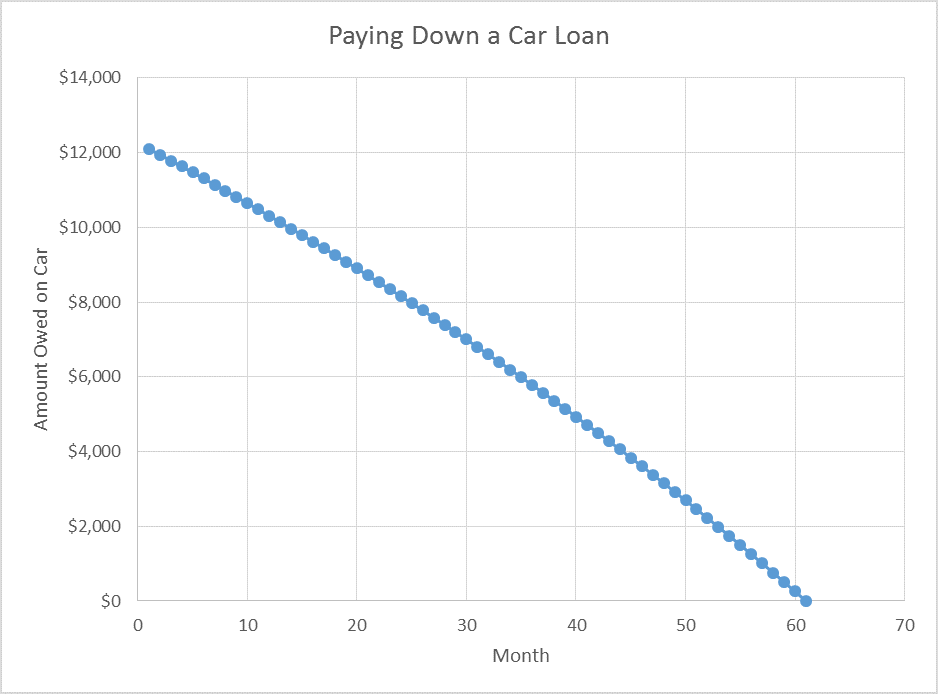

It is a common belief that over the 60 months of such a loan that the borrower would pay down the loan principal evenly as the graph below shows.

The above graph incorrectly depicts the loan being paid down by $200 per month until the balance reaches $0. This graph would imply that for each payment $54.96 goes towards paying interest, because $254.96 minus $200 is $54.96. Car loan interest does not work this way.

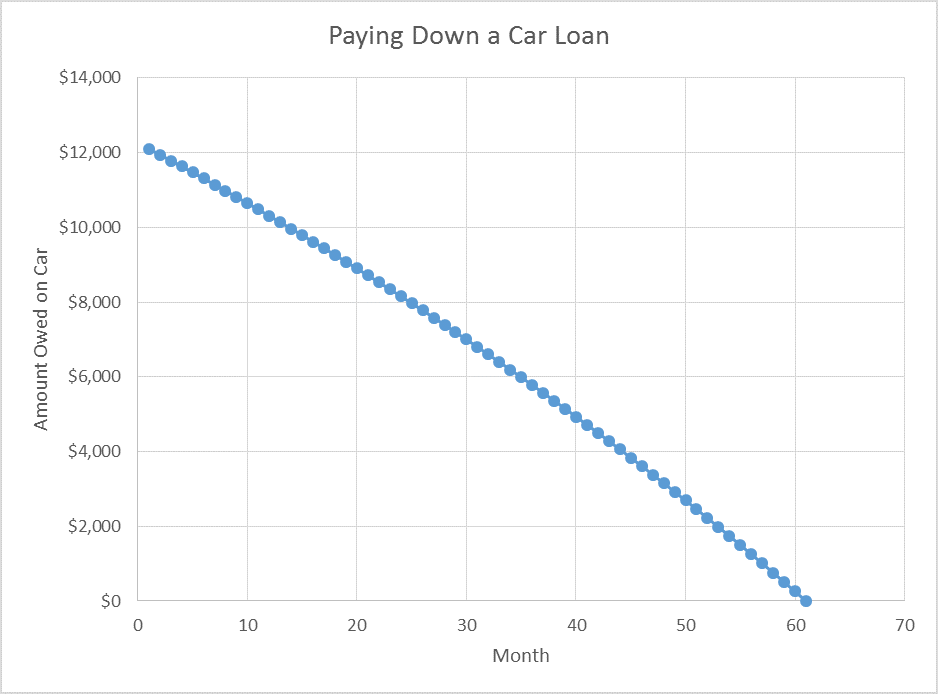

The correct payoff graph actually looks like the following.

Notice how the payoff curve is bowed so that it is less steep at the beginning of the loan than at the end. The reason that car loans behave this way is that monthly payments at the beginning of a car loan include more interest charge than the payments at the end of a car loan. Let’s look more closely at why car loans work this way.

As already mentioned, the monthly payments on the loan in this example would be $254.96. The interest charge that is included in this payment is based off of how much you owe on the loan. So, for the first payment on this loan, your interest charge would equal the portion of the 10% yearly interest accrued in the first month on the full amount that you are borrowing, which means that you have to pay interest of 10%/12 months on the full $12,000. Thus, the amount of interest you pay for the first payment is $100 [$100 = 10%/12 months * $12,000). Consequently, with the first payment, you will pay down your principal by $154.96 [$154.96 = $254.96 – $100].

For the second month’s payment, you will pay a slightly smaller interest charge, because the first month’s payment will have paid down the principal by $154.96. So, the second payment will include $98.71 of interest charge [$98.71 = (10%/12 months) * ($12,000 – $154.96)], and will pay down the principal by $156.26 [$156.26 = $254.96 – $98.71].

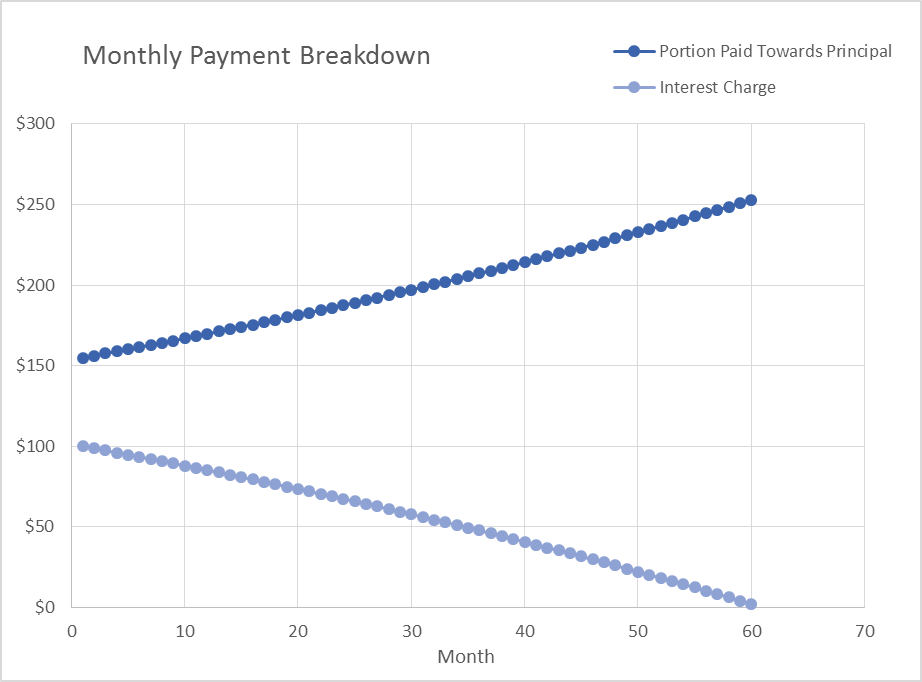

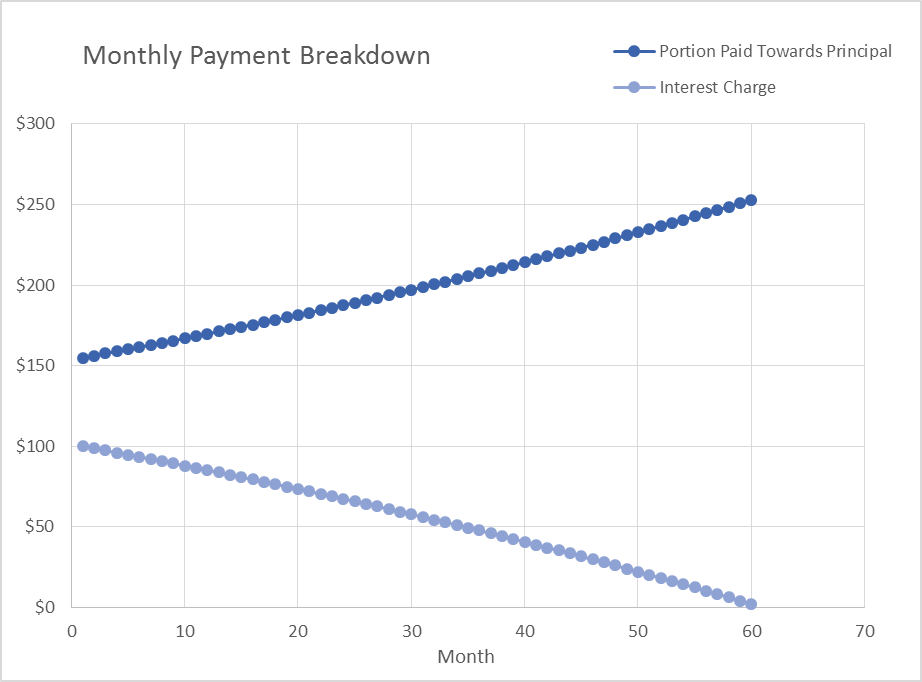

In this way, as you pay down a car loan, the amount of interest charge you pay decreases while the amount of principal you pay for increases, all while the monthly payment remains the same. For our example, the graph below illustrates how during the course of the loan the interest charge per month would fall while the amount each payment contributes to paying the principal increases if all the monthly payments are paid as scheduled.

Neither of these curves are straight lines. Rather, the interest charge line decreases at an increasing rate while the line displaying how much of the principal each payment covers actually increases at an increasing rate. Ultimately, you would end up paying a total of $15,298 [$15,298 = 60 * $254.96] on the loan of which $3,298 [$3,298 = $15,298 – $12,000] would be from interest charges.

How Does My Car Loan Term Length Affect My Interest Charge?

It is important to realize that your interest rate is not the only factor that affects the total amount of interest charge you pay for your car loan. Your car loan term length plays a major role in how much you pay for your car no matter what interest rate you have. As a general rule, for the same interest rate, the longer your term length, the more your cumulative interest charge will be.

Let’s continue the example above to illustrate this principle. Suppose still that you are financing your $12,000 car with a car loan requiring you to pay a 10% interest rate. However, you have a choice between a four year loan (or 48 months) and the five year loan (or 60 months) that we have discussed so far. The 48 month loan would require monthly payments of $304.35 while the 60 month loan would still require the $254.96 payments. Looking at the monthly payment, you may be tempted to take the 60 month loan because it saves you money every month – and this decision is not necessarily wrong. Still you should consider the effect the extra 12 months will have on the interest charges you pay over the course of the loan. Remember, you have to pay 10% interest on the balance on your loan, so the longer you owe money on your car, the more interest you have to pay.

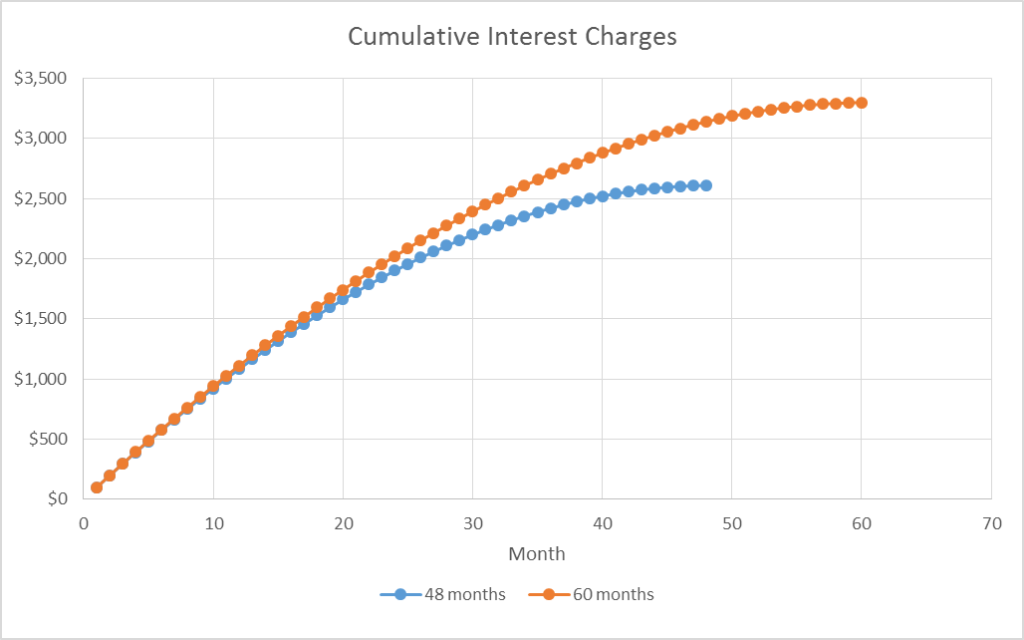

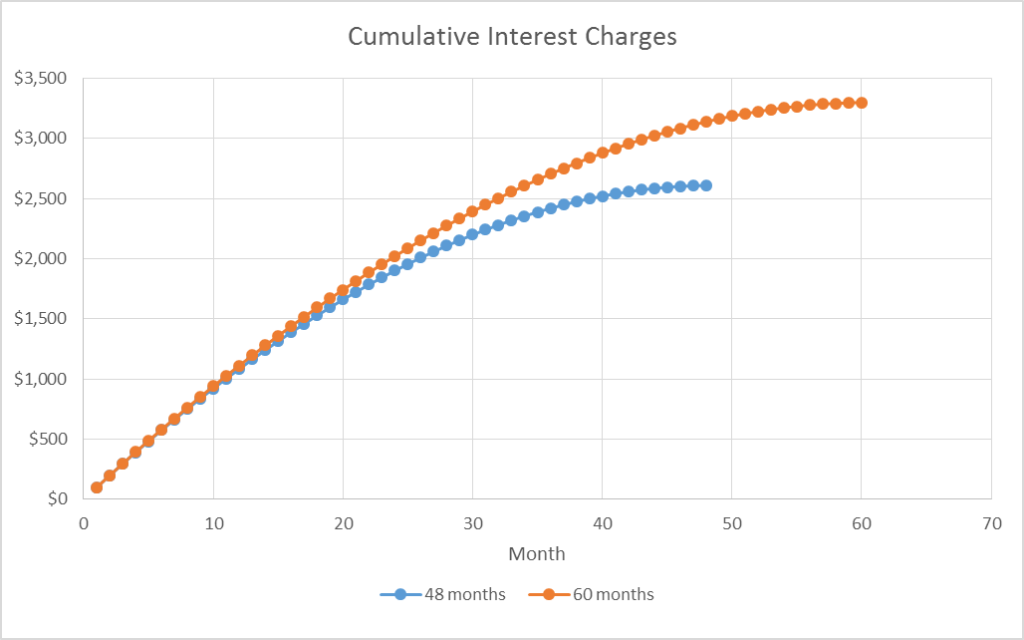

The graph below shows how the interest charges accumulate over the course of each loan.

As you can see, the total interest charges you pay on the 60 month loan climb higher than those of the 48 month loan. Moreover, the 60 month loan levels off later than the 48 month loan, meaning that the portion of each of your monthly payments that covers your monthly interest charges is greater for the 60 month loan than for the 48 month loan. In total, you would pay interest charges of $2,608.85 for the 48 month loan versus $3,297.87 for the 60 month loan.

At this point, it is important to note that it is possible to have a longer car loan term length and still pay less for your car than with a loan of a shorter term length if your longer term loan has a sufficiently lower interest rate. Understanding interest rates and loan term lengths and how they interact is important if your are considering refinancing a car because refinance customers often both extend their term lengths and secure lower interest rates. Furthermore, the concept of how car loan term length affects your cumulative interest charges has important implications for how you can save money on your current car loan.

How Can I Reduce My Interest Charges on My Auto Loan?

Since your interest charge every month is based on how much you still owe on your loan, you can reduce your interest charges by making unscheduled payments that bring down your loan balance. When you make unscheduled payments, you are engaging in an accelerated car loan payoff which will reduce the total amount of interest charges you pay over the course of your loan and may help you pay back your loan faster than originally planned.

Paying a debt like a car loan early is generally a good thing, because you end up paying less interest charges. However, you should always consider your entire financial situation before choosing to make unscheduled payments. Obviously, you need to have the extra cash to make such a payment, but even if you do, you have to ask yourself if you have better uses for that extra money. For example, if you owe money on a credit card, then you are probably better off paying down that credit card’s balance before making an unscheduled car loan payment. Ultimately, you should consider carefully if an accelerated payoff makes sense for you.

If you cannot afford to pay extra each month for your car loan, but would still like to pay less for your car in the long run and/or reduce your monthly payments, you may want to consider refinancing your car. If you refinance to a lower interest rate, you may pay significantly less for your car loan in the long-run and reduce your monthly payments.

Want to Save On Your Car Payment?

Refinancing may help lower your payments and/or interest rate. Pre-qualify now with no credit impact.

Check Your Rates

Trustpilot

How Do Taxes Affect the Auto Loan Interest I Pay?

While taxes are generally a complicated issue and need to be worked out on an individual basis, the concept of how taxes affect your car loan is straightforward. When buying a car, you are charged taxes on the price of the car you are purchasing, meaning the amount of tax you owe is added directly to your loan amount. So, if you wish to buy a car for $20,000 and you owe taxes on it of 8%, then you will owe $1,600 [$1,600 = $20,000 * 8%] in taxes and thus will need a car loan for $21,600.

Notice that your tax rate will not change the interest rate you will owe on your loan. However, the amount you must borrow to pay for your taxes will be included in the amount you borrow from the lender, and you have to pay interest on the full amount you borrow. Your taxes do not increase your interest rate, but they do increase the loan balance on which your interest charges are based.

Unfortunately, taxes are a part of life and are unavoidable. Still, it is important that you understand how your tax rate will influence your auto loan.

What Does APR Mean on an Auto Loan?

While shopping for car loans, credit cards, and other financial services, you have probably come across the term APR. APR stands for “Annual Percentage Rate.” It is the annual rate of finance charge you pay for your loan or credit line. For car loans, APR is the rate you pay that accounts for your interest charges plus all other fees you have to pay to get your loan.

To clarify how much you will pay in interest charges versus how much you will pay in interest charges plus fees, your car loan paperwork will likely come with two rates. Each rate gives you different information about your loan, yet mathematically they are the same in that they both give you the same payment (the one quoted on your loan paperwork) and both require you to pay the same amount for you car over the course of you loan.

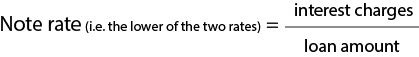

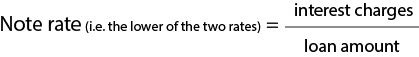

The lower of the two rates is your interest rate or note rate. This rate describes how much in interest charges you will pay on the balance of your loan over a year period.

The higher rate will be your APR. The APR accounts for the total finance charge you pay on your loan in a given year. The finance charge is made up of both your interest charges and your prepaid finance charges, which are various charges rolled into your loan amount that can include different loan fees and the interest that accumulates to the day of your first loan payment. Even though your prepaid finance charges are included in your loan principal and so are indeed “prepaid,” you still pay for those fees with your car payments over the course of your loan, making the prepaid charges more like interest charges. Remember, just because your APR is higher than the interest rate quoted to you does not indicate that your lender has changed the loan terms it is offering you.

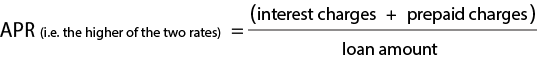

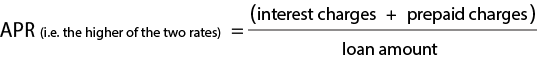

You can think of your two rates as follows.

(Note, the “loan amount” is the balance on your loan principal, which is the amount you borrow. The “interest charges” are those paid in a 12 month period.)

(Note, the “loan amount” is the balance of your amount financed or the amount you need to buy or refinance your car. The “interest charges + prepaid charges” are those paid in 12 month period.)

Please note, while these equations are helpful for understanding these two rates, they do not necessarily reflect how you would calculate the two rates. However, you can read much more about how APR works here, including how to use the above equations to correctly estimate your note rate or APR.