Best Credit Cards for Online Shopping in India

YES Bank Paisabazaar PaisaSave Credit Card

Joining fee: ₹0

Annual/Renewal Fee: ₹499

3% Cashback Points on e-commerce spends, max. 5,000 points/month

Unlimited 1.5% Cashback Points on all other spends

Product Details

- Earned Cashback Points can be redeemed as statement credit in 1:1 ratio at zero redemption fee

- Renewal fee waived off on reaching Rs. 1.2 lakh annual spends

- 1% fuel surcharge waiver, up to Rs. 250 per month, on all fuel spends worth Rs. 500 to Rs. 3,000

Know More

Cashback SBI Card

Joining fee: ₹999

Annual/Renewal Fee: ₹999

5% cashback on all online spends

1% cashback across all offline spends

Product Details

- 5% cashback across all online spends with no merchant restriction

- 1% cashback across all offline spends

- Earn cashback of up to Rs. 5,000 per month

- Renewal fee reversed on spending at least Rs. 2 lakh in a year

- 1% fuel surcharge waiver of up to Rs. 100 per month

Know More

Amazon Pay ICICI Credit Card

Joining fee: ₹0

Annual/Renewal Fee: ₹0

Up to 5% cashback on Amazon purchases

1% cashback across all offline spends

Product Details

- 5% cashback on Amazon spends for Prime members

- 3% cashback on Amazon spends for non-Prime members

- 2% cashback on spends at Amazon Pay partner merchants

- 1% cashback on other spends

- 1% waiver on fuel surcharge across all petrol pumps in India

Know More

Flipkart Axis Bank Credit Card

Joining fee: ₹500

Annual/Renewal Fee: ₹500

5% cashback on transactions at Flipkart and Cleartrip

4% cashback on partner merchants, like Swiggy, PVR, Uber, etc.

Product Details

- 1% cashback across other spends

- 4 complimentary domestic airport lounge visits in a year on spending at least Rs. 50,000 in a year

- Activation benefits worth Rs. 600 from Flipkart and Swiggy

- 1% fuel surcharge waiver on transactions between Rs. 400 and Rs. 4,000

Know More

Myntra Kotak Credit Card

Joining fee: ₹500

Annual/Renewal Fee: ₹500

7.5% off up to Rs. 750 per transaction on Myntra

Unlimited 1.25% cashback on other spends

Product Details

- 7.5% off up to Rs. 750 per transaction on Myntra

- 5% cashback up to Rs. 1,000 per month on Swiggy, Swiggy Instamart, PVR, Cleartrip & Urban Company

- 1.25% cashback across all other transactions

- 2 complimentary PVR tickets of Rs. 250 each on Rs. 50,000 quarterly spends

- 1% fuel surcharge waiver of up to Rs. 3,500 in a year on fuel spends of Rs.500 to Rs. 3,000

Know More

HDFC Millennia Credit Card

Joining fee: ₹1000

Annual/Renewal Fee: ₹1000

5% cashback on Amazon, BookMyShow, Flipkart, Myntra, Zomato & more

1% cashback on spends at other categories

Product Details

- 1 complimentary lounge access or a voucher of Rs. 1,000 on spending Rs. 1 Lakh in a quarter

- Up to 20% off on dining at partner restaurants via Swiggy Dineout

- 1% fuel surcharge waiver on transactions between Rs. 400 and Rs. 5,000

Know More

HDFC MoneyBack+ Credit Card

Joining fee: ₹500

Annual/Renewal Fee: ₹500

10X CashPoints on Flipkart, Amazon, Swiggy, Reliance Smart SuperStore & BigBasket

5X CashPoints on EMI transactions at select merchants

Product Details

- 2 CashPoints per Rs. 150 spent on other categories

- 500 CashPoints as welcome benefit after the payment of joining fee

- Gift vouchers worth up to Rs. 2,000 in a year as milestone benefits

Know More

American Express SmartEarn™ Credit Card

Joining fee: ₹495

Annual/Renewal Fee: ₹495

10X Membership Rewards® Points on Zomato, Flipkart, Myntra, etc.

5X Membership Rewards® Points on spends at Amazon

Product Details

- 1 Membership Rewards® Point per Rs. 50 spent on other categories

- Rs. 500 voucher each on achieving annual spends of Rs. 1.20 Lakh, Rs. 1.80 Lakh & Rs. 2.40 Lakh respectively

- 1% convenience fee on fuel purchases above Rs. 5,000 at HPCL Petrol Pumps

Know More

SBI SimplyCLICK Credit Card

Joining fee: ₹499

Annual/Renewal Fee: ₹499

10X reward points on top online brands – BookMyShow, Swiggy, Myntra, etc.

5X reward points on other online spends

Product Details

- 1 reward point for every Rs. 100 spent on other categories

- Amazon India gift card worth Rs. 500 on joining fee payment

- Cleartrip/ Yatra e-voucher of Rs. 2,000 each on reaching annual spending milestones of Rs. 1 lakh and Rs. 2 lakh

- Annual fee waived on reaching Rs. 1 lakh annual spends

- 1% fuel surcharge waiver on fuel spends between Rs. 500 to Rs. 3,000

Know More

Best Credit Cards for Offline Shopping in India

Axis Bank SELECT Credit Card

Joining fee: ₹3000

Annual/Renewal Fee: ₹3000

2X EDGE Reward Points acrosss all retail transactions

10,000 EDGE Reward Points worth Rs. 2,000 as welcome benefit

Product Details

- 10 EDGE Reward Points on every Rs. 200 spent

- Flat Rs. 500 off per month on BigBasket on minimum spend of Rs. 3,000

- Rs. 200 off on Swiggy, twice a month, on minimum spend of Rs. 1,000

- Up to 12 complimentary international lounge visits in a year & 2 domestic lounge visits per quarter

- Up to 12 complimentary golf rounds in a year

Know More

HDFC Regalia Gold Credit Card

Joining fee: ₹2500

Annual/Renewal Fee: ₹2500

5X reward points on Nykaa, Myntra, Marks & Spencer and Reliance Digital

4 reward points per Rs. 150 across all retail spends

Product Details

- Complimentary Club Vistara Silver & MMT Black Elite Memberships

- Gift voucher worth Rs. 2,500 on the payment of joining fee

- 6 complimentary international lounge visits & 12 complimentary domestic airport lounge visits per year

- Marks & Spencer, Reliance Digital, Myntra or Marriott vouchers worth Rs. 1,500 on Rs. 1.5 Lakh quarterly spends

- Flight vouchers worth Rs. 5,000 on annual spends of Rs. 5 Lakh

Know More

SBI Prime Credit Card

Joining fee: ₹2999

Annual/Renewal Fee: ₹2999

5X reward points on dining, groceries, departmental stores, and movies

8 international Priority Pass & 4 domestic airport lounge visits per year

Product Details

- 10X reward points on birthday spends; 2 reward points per Rs. 100 on other retail purchases

- Complimentary Club Vistara Silver membership

- E-gift vouchers worth Rs. 3,000 of popular brands, such as Yatra, Pantaloons, etc., as welcome benefits

- Pizza-hut gift voucher worth Rs. 1,000 on quarterly spend of Rs. 50,000

- Yatra/ Pantaloons gift voucher worth Rs. 7,000 on spending Rs. 5 lakh in a year

Know More

Tata Neu Infinity HDFC Credit Card

Joining fee: ₹1499

Annual/Renewal Fee: ₹1499

5% NeuCoins on all non-EMI spends at Tata Neu & its partner brands

8 domestic and 4 international Priority Pass lounge access per year

Product Details

- 1,499 NeuCoins after the first spend within 30 days of card issuance

- 1.5% NeuCoins on UPI, non-Tata brand and merchant EMI spends

- Additional 5% NeuCoins on select spends at Tata Neu app/website

- Low forex markup fee of 2%

Know More

Reliance SBI Card PRIME

Joining fee: ₹2999

Annual/Renewal Fee: ₹2999

10 Reward Points per Rs. 100 spent at Reliance Retail Stores

Reliance Retail vouchers of up to Rs. 14,999 on joining

Product Details

- 5 Reward Points per Rs. 100 spent on dining, movies/entertainment, domestic airlines and international spends

- 2 Reward Points per Rs. 100 spent on other retail spends; 1 Reward Point = Rs. 0.25 for Reliance Retail vouchers

- Reliance Retail vouchers of up to Rs. 8,750 on up to Rs. 3 lakh annual spends made at select Reliance Retail Stores

- 8 complimentary visits to domestic and 4 to international airport lounges every year, up to 2 per quarter each

- 1 free movie ticket a month of up to Rs. 250 & discount offers at select Reliance Retail stores

Know More

Lifestyle Home Centre SBI Card SELECT

Joining fee: ₹1499

Annual/Renewal Fee: ₹1499

5X Reward Points on Home Centre, Lifestyle, Max, Spar, dining & movies

Up to 34,400 Reward Points worth Rs. 8,600 as milestone benefits

Product Details

- 2 Reward Points per Rs. 100 spent on other spends; 6,000 Reward Points worth Rs. 1,500 on joining & renewal

- 2,400 bonus Reward Points on annual spends of Rs. 25,000 across all Landmark Stores

- 8,000 bonus Reward Points on annual spends of Rs. 75,000 across all Landmark Stores

- 12,000 bonus Reward Points on annual spends of Rs. 1.5 lakh across all Landmark Stores

- 12,000 bonus Reward Points on overall Rs. 3 lakh annual retail spends

Know More

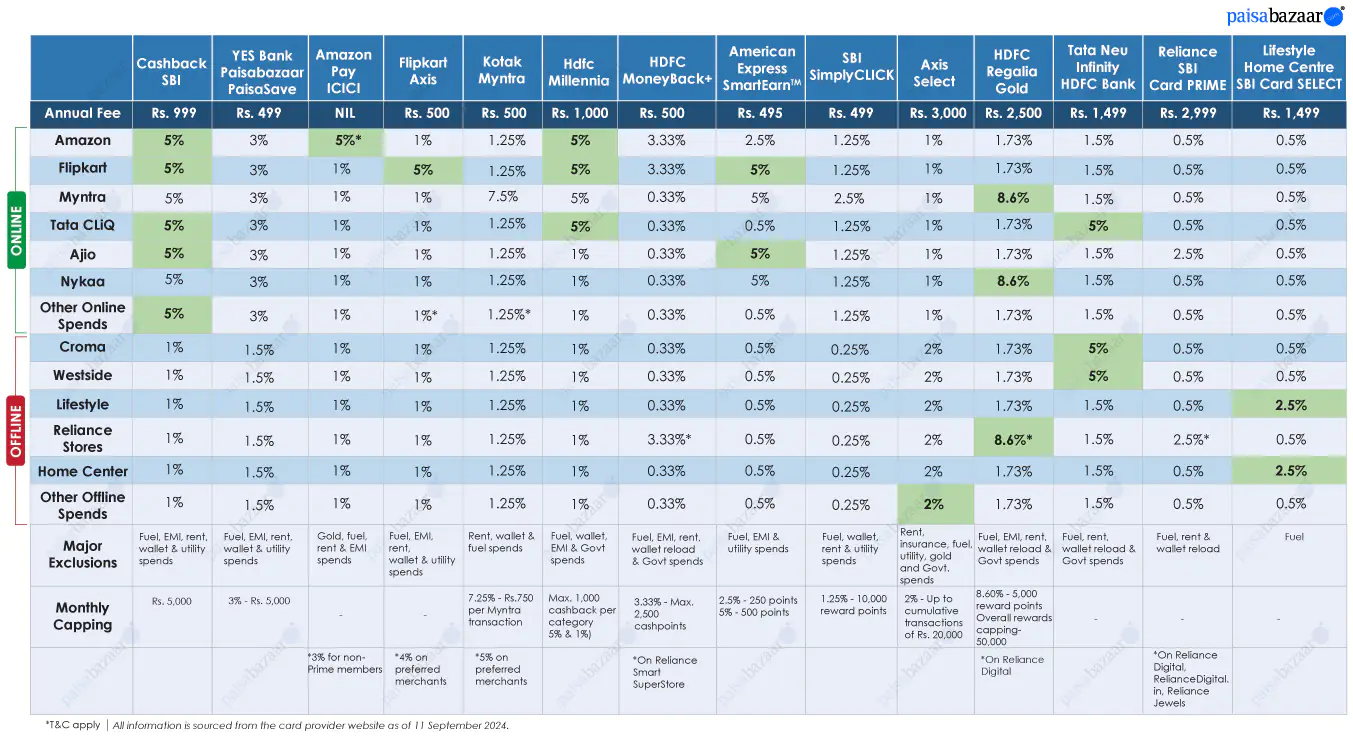

Value-back Comparison: Top Shopping Credit Cards

To help you find the right card, here we have compiled the value-back offered on top shopping credit cards in India around popular online and offline shopping brands. Look for a card that can help you earn substantial returns on your major purchases, justifying the fee you pay and benefits you derive as aligned with rewards capping and exclusions.

How to choose the right shopping credit card?

Different people have different shopping needs. For instance, some would prefer e-commerce platforms over stores, while others would have preferences even among these online shopping websites. Your choice of the right shopping card will depend on how you plan to use the credit card. We have categorized the shopping credit cards above based on what category they are best suited for.

Once you have decided why you need the card and have shortlisted a few, the next step would be a comparison of those cards on the following grounds:

- Flexibility of Benefits (Cashback/Reward redemption process)

- Final Value Back (Cashback percentage/Rewards value in Rupee)

- Annual Fee

- Welcome Gift/ Sign-up Bonus